April 2022 Market Watch

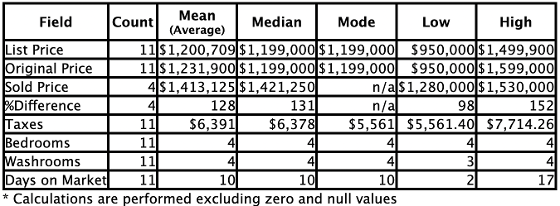

March 2022 Fallingbrook R.E. Sales Stats

Realtor.ca article - Why a Smaller City Could Be a Good Move

Michelle McNally

Michelle McNally is a news writer for Livable, specializing in buyer guides and market explainers. She is a journalism graduate of Ryerson University and a past intern of CBC News Network. Michelle is a former market specialist for Livabl's parent company, BuzzBuzzHome, where she focused on developments along the American east coast. Michelle wrote her first literary epic in Grade 8 about a zombie who loved Fruit Loops. She enjoys baking and follows too many famous corgis on Instagram.

Why a Smaller City Could Be a Good Move

Over the course of the pandemic, homeowners have been re-evaluating what they need most out of their property. For some, this has meant packing up and downsizing to a smaller city or community for greater living space, privacy, and a more relaxed pace of life.

Both statistically and anecdotally, we’ve witnessed buyers moving to the suburbs and other rural areas over the past two years. Small towns like Squamish, Wasaga Beach, Kingston, and Collingwood have been home to some of Canada’s fastest-growing populations lately, a trend largely attributed to residents moving from urban centres in search of more affordable housing, according to a report from RBC Economics.

Link to full article https://go.shr.lc/3rgBQVy

Thinking about moving to a small town or city?

We can help! Call or text us today at 905-409-9967

March 2022 Market Watch

JUST SOLD - 658 Berwick Cres

February 2022 Market Watch

Rate Alert from Bank of Canada

Ask yourself these 4 "W" questions to make your decision to move an easy one.

Whether you’re contemplating buying your first home, investment property, deciding to downsize or move to a bigger home, there are many questions that need to be answered before you can get started.

Ask yourself these 4 "W" questions to make your decision to move an easy one.

1. WHY are you buying/moving?

Get grounded in why you want to move. Is it finally time to purchase your first home? Do you need more space for your growing family or now that the kids have left, is the big house too much? Are you moving because of necessity? Maybe relocating for work or some other reason. It can be tempting when you start looking at beautifully staged homes online to start imagining yourself elsewhere. This will help you stay focused on your needs and help you get real about whether now is the time to make a move.

2. WHEN would you like to be moved in?

Do you have a timeline or a deadline that you have to be moved by? This will put your search into perspective. If you need to move asap you have the motivation to get started now. If you want to be opportunistic you may want to be more aggressive in your preparation to ensure you’re ready if the right opportunity comes along. If not, you can take it slow. Either way finding the right resources, Realtors®, lenders who can support you at a pace that works for you is key.

3. WHERE would you like to be?

Is there a specific area, community, or building you want to be in? Would you like to be closer to work, transit, recreation, schools, family/friends? Having a firm idea will allow you to assess your options and determine if you can make your move now. As your Realtor® we can help you assess the types of properties available in your desired area(s) and what home values are there.

4. WHAT type of home do you see yourself in vs. What you can afford?

This one is a two-parter. In today’s competitive market housing prices can be deceiving so getting a clear picture of what you’re looking for vs. what you can afford is the key final step to determining if now is the right time for you to make a move.

-

What kind of home would you like to live in?

Would you prefer a condo or freehold, townhouse or detached? Bungalow, 2-story or split-level? New or resale? How big? How many bedrooms, bathrooms? Backyard or no backyard? How do your options reflect your needs or the needs of your family? What are your must-haves vs. your nice to haves?

-

What is your budget to purchase that home?

Understanding what you can afford will help narrow down your options to the best homes for you. From there you can determine if you’re ready to make a move.

Working with your Realtor®, we can connect you with lenders to help you understand your financing options. As your Realtors® we can help find the ideal properties that meet your needs within your budget and guide you through the whole process from start to finish.

Call us at the JSA team and we can help you gain greater clarity on your options and connect you to valuable resources to help you make this important decision. We treat our clients and prospective clients the way we’d want to be treated if we were in your shoes. Whether you're ready now or not, it's ok. No pressure. Just people helping people.

SUTTON AWARDS FOR 2021

Canada real estate: Ontario mayors give their take on soaring home prices

Homebuyers are used to Canada's real estate prices being led higher by big cities like Toronto, but few anticipated what would unfold in smaller cities and towns when COVID-19 hit.

The pandemic made many rethink their living situation. Working from home while being cooped up in a small condo wasn’t working, and big-city living was expensive.

So, buyers sought out more space and decided to drive until they qualify, especially in Ontario where prices have risen the most since the start of the pandemic. Low-interest rates also helped drive people into ownership.

Many ended up hours away from Toronto in places like Bancroft, the country’s leader in year-over-year average price gains of an astonishing 48 per cent.............Read More

Choosing a Realtor

Here are 3 things to consider when choosing a Realtor®

Will they make you a priority? Are you their primary client or just one of several they are trying to service right now? You want an experienced Realtor® or team on your side working in your best interests. If they can’t put you first, it’s time to interview another agent.

Will they explain the process? It’s great to get down to brass tax but you need to know what to expect so there aren’t any surprises.

How well do they know the local market? Whether buying or selling you need a partner who’s familiar with home values in your market.

As a family-run business, our team’s focus has always been on service. Focusing on your unique needs is a priority for us. We want your real estate experience stress free so we explain the process and connect you to the resources you need. Finally, we study the market we serve every day so you can feel confident on offer day.

Call us today for a free no-obligation home buying and selling consultation.

Jim Direct: 905-409-9967

Ben Direct: 905-995-3372

.png)